The cryptocurrency industry is known for its innovative spirit and volatile markets, but recently, legal troubles have been grabbing headlines. Two major figures—Roger Ver and Changpeng Zhao—face legal repercussions, raising concerns about regulation and accountability within the crypto space.

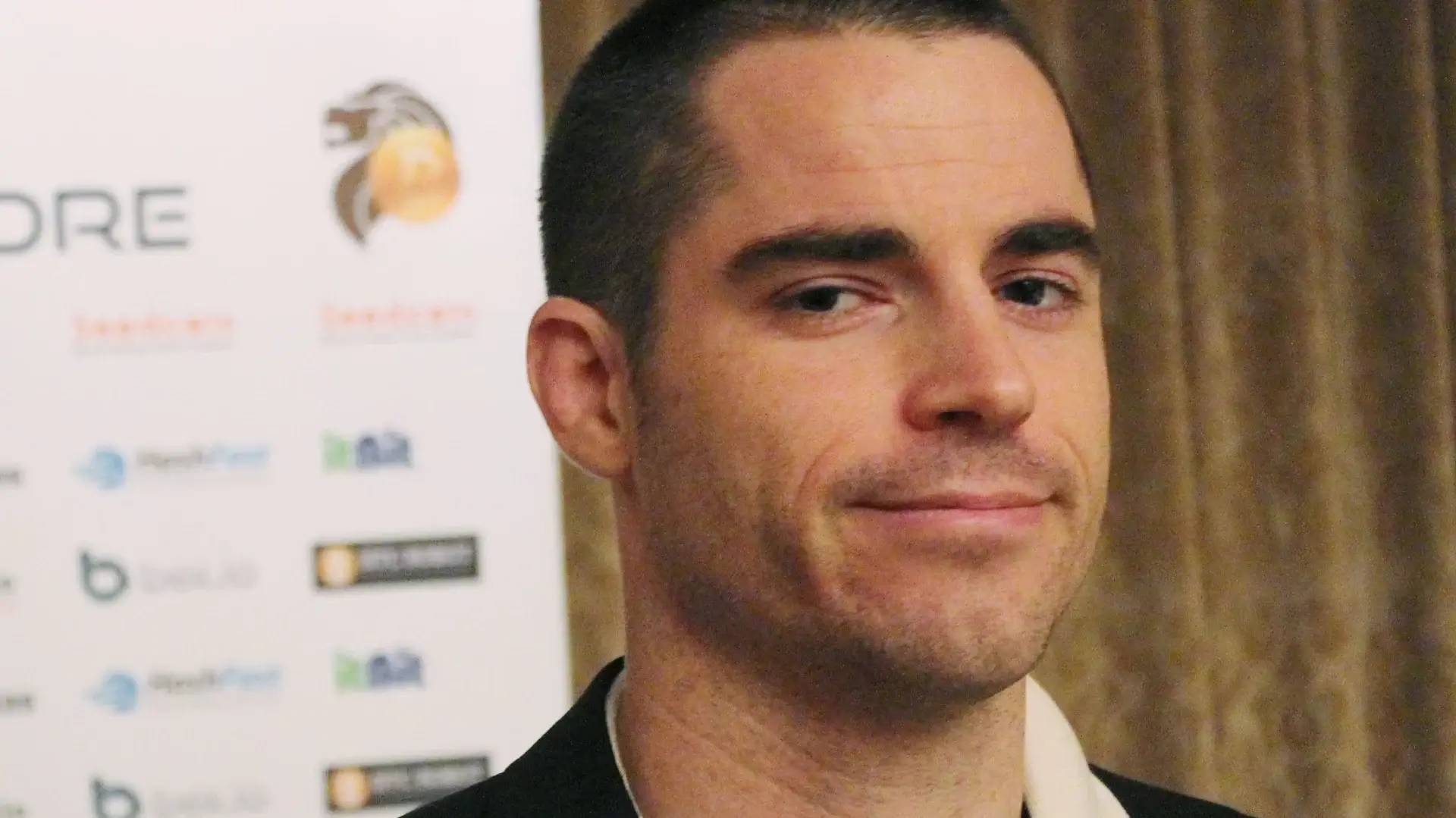

Roger Ver Faces Tax Fraud Charges:

Nicknamed “Bitcoin Jesus” for his early and vocal support of Bitcoin, Roger Ver finds himself on the wrong side of the law. He was arrested in Spain on charges of tax evasion. The US Department of Justice alleges Ver failed to report and pay taxes on his Bitcoin holdings, potentially costing the IRS a staggering $48 million. This case highlights the complex issue of taxation in the cryptocurrency world. While Ver renounced his US citizenship, US law still requires him to report worldwide capital gains.

Binance Founder Receives Prison Sentence:

Changpeng Zhao, founder of the world’s largest cryptocurrency exchange Binance, isn’t escaping legal scrutiny either. He recently received a four-month sentence for failing to implement adequate anti-money laundering (AML) protocols at Binance. Prosecutors argued that these lax measures allowed criminals to use the platform for activities like money laundering and financing terrorism. This verdict sends a strong message to cryptocurrency exchanges about the importance of robust AML compliance.

What These Cases Mean for the Future of Crypto

These legal troubles cast a shadow on the cryptocurrency industry, raising questions about its legitimacy and potential risks. However, they also represent a turning point. Regulatory bodies are taking a more active role, demanding greater accountability from crypto businesses and their founders. This increased scrutiny could benefit the industry by fostering a more secure and transparent environment.

What to Watch Out For:

Investors and users should be aware of these ongoing legal developments. Here’s what to keep an eye on:

- The outcome of Roger Ver’s case: Will he be extradited to the US and face trial?

- Regulatory changes: How will these cases influence future regulations for cryptocurrency exchanges?

- Improved AML compliance: Will Binance and other exchanges implement stricter measures to prevent illegal activity?

The future of cryptocurrency hinges on trust and transparency.

These legal cases serve as a reminder of the need for responsible behavior from industry leaders and clear regulations from governing bodies. While challenges remain, these developments could pave the way for a more mature and sustainable cryptocurrency ecosystem.