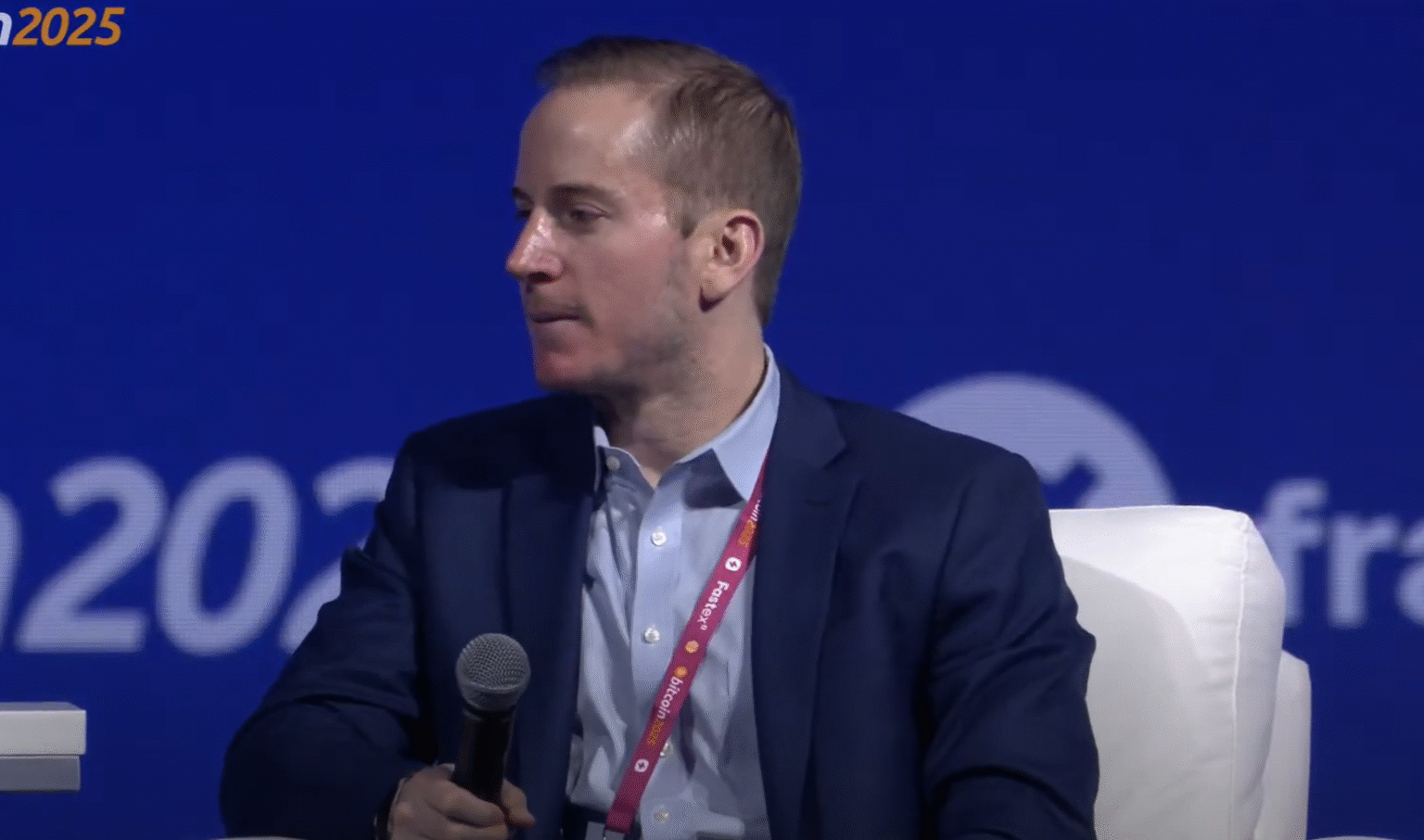

Speaking from the Nakamoto Stage at the Bitcoin 2025 Conference, Robert Mitchnick, Head of Digital Assets at BlackRock, made a compelling case for BTC’s unique position in global finance—suggesting that the world’s largest asset manager sees Bitcoin not only as a legitimate portfolio hedge but also as a superior alternative to gold.

While IBIT has already gained massive traction in US markets, BlackRock has recently launched a similar product in Europe and sees global expansion as essential. “We’re excited,” Mitchnick said. “This has really been a global story… even if you look at IBIT’s numbers, a massive amount of that actually comes from offshore wealth channels, including Asia.”

Mitchnick pushed back hard against the long-standing claim that BTC merely behaves like a speculative tech stock. “Through most of Bitcoin’s history, it’s had very low correlation [to equities],” he noted. While he acknowledged periods of short-term alignment—particularly among leveraged retail traders—he argued that institutional investors see BTC differently: “They view Bitcoin as a differentiator in a portfolio and a potential hedge against some of the left-tail risks that exist elsewhere in traditional assets.”

Asked directly about the ongoing gold-versus-BTC debate, Mitchnick avoided the typical zero-sum framing. “They’re both global, scarce, decentralized, fixed-supply assets,” he said. “Gold has much less volatility and a longer history. But Bitcoin is digitally native, efficient to store, and can be transferred anywhere in near real time at near-zero cost.” Then he delivered the verdict: “Bitcoin has much higher upside than gold—and lower downside.”

He also addressed why this narrative isn’t more dominant. “It’s amazing to me that the industry hasn’t promoted this more effectively,” he said, criticizing financial media and research firms that still link BTC’s value to irrelevant macro headlines. “Bitcoin’s never heard of tariffs. Doesn’t know what they are.”

On the topic of regulation, Mitchnick welcomed the growing bipartisan interest in Washington. “It’s just a great and encouraging thing that there is such momentum behind developing a regulatory framework,” he said. “Whether we’re talking about stablecoins or market structure, there’s great momentum there—and we’re excited to see how that shakes out.”

At press time, BTC traded at $108,879.