The coordinated accumulation suggests confidence in XRP’s ability to break through overhead resistance from investors with deep pockets.

The technical formation adds weight to the whale buying pattern, providing both fundamental and technical support for a potential upward move.

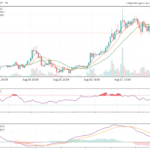

The TD Sequential, a momentum oscillator used to identify potential reversal points, typically generates buy signals when an asset becomes oversold and positioned for a bounce.

However, the bullish signs happen amid conflicting market signals for altcoin performance.

While Bitcoin consolidated after reaching a price peak, Ethereum led an altcoin recovery, resulting in new all-time highs above $4,950, as ETF flows and corporate treasury demand provided support.

The analysis noted that altcoin market capitalization is stagnating, with movement in individual tokens representing capital rotation rather than new inflows.

The report warned that September could mark a cyclical low point for altcoins before structural drivers reassert themselves in the fourth quarter.

Despite the mixed backdrop, whale accumulation in XRP persists during periods of price weakness. Additionally, analysts anticipate the approval of multiple altcoin ETFs in the US in October, including those for XRP.

The report added that even if the near term turns out grim, current fundamental and technical indicators suggest a rally for XRP is likely in the coming weeks.