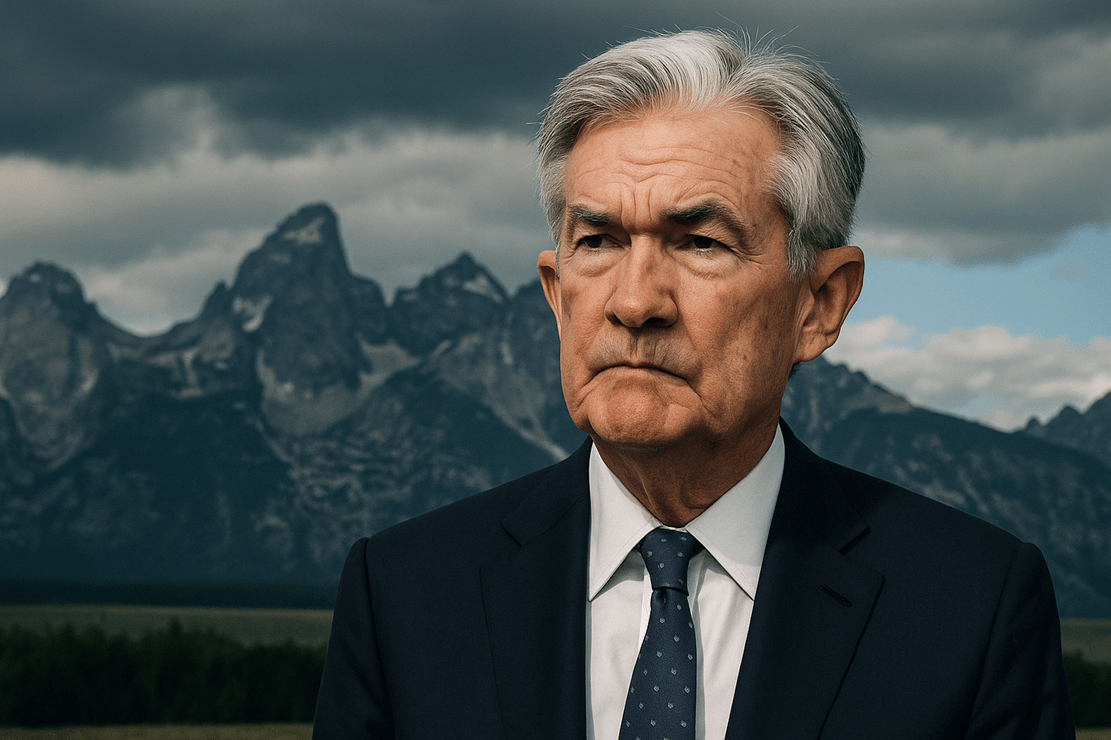

The crypto market slid into the week in a holding pattern, with price action grinding sideways and positioning increasingly tethered to one catalyst: Federal Reserve Chair Jerome Powell’s remarks at the Jackson Hole Economic Policy Symposium. “The only big, big event is going to be this,” said analyst Josh Olszewicz in his August 18 Macro Monday stream. “Everybody’s going to be watching this, talking about this, analyzing this… What Jay says [on Friday]” will likely swing rate expectations and risk sentiment. The symposium runs August 21–23, 2025 in Wyoming, under the theme “Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy,” a backdrop almost tailor-made for clarifying the Fed’s path into autumn.

Technically, he described the near-term as “a giant, giant nothing burger.” For Bitcoin, he pointed to a $120,000–$122,000 zone as the threshold for a cleaner long setup, and for MicroStrategy he flagged “anything above $410, and it’s go time,” while conceding that the stock’s momentum is “slipping away quicker and quicker.” Across crypto equities, he saw little that was “screaming” long: exchanges and brokerages looked momentumless on his cloud models; miners’ recent strength owed more to AI/HPC stories than to crypto beta; and even the prominent ETH-linked equities that surged since spring now show “record volumes” but a “more neutral” low-timeframe picture. “There’s no reason to force trades when they’re not there,” he said.

All roads, however, lead back to Powell. As of Tuesday, broader markets were leaning toward a September rate cut, with futures-implied tools like CME’s FedWatch reflecting a high probability of a 25 bps move. “We’re seeing 83% for a cut at the next meeting,” Olszewicz said of the market’s starting point, adding that if expectations “shift towards no cut, I’d expect the markets to be very angry,” whereas a surprise 50 bps “is probably unlikely” but would be greeted “in a bullish, happy way.”

Between now and then, the Chair’s tone on inflation progress, labor-market cooling, and the possibility of pre-emptive easing will determine whether this week’s “nothing burger” becomes the base for a new leg higher—or a reminder that macro still has the final say at the top of crypto’s risk cascade. And with Jackson Hole’s explicit focus on labor markets this year, Powell’s framing may do more than nudge September probabilities; it could reset how investors think about the entire path of policy into 2026.

At press time, the total crypto market cap stood at $3.84 trillion.