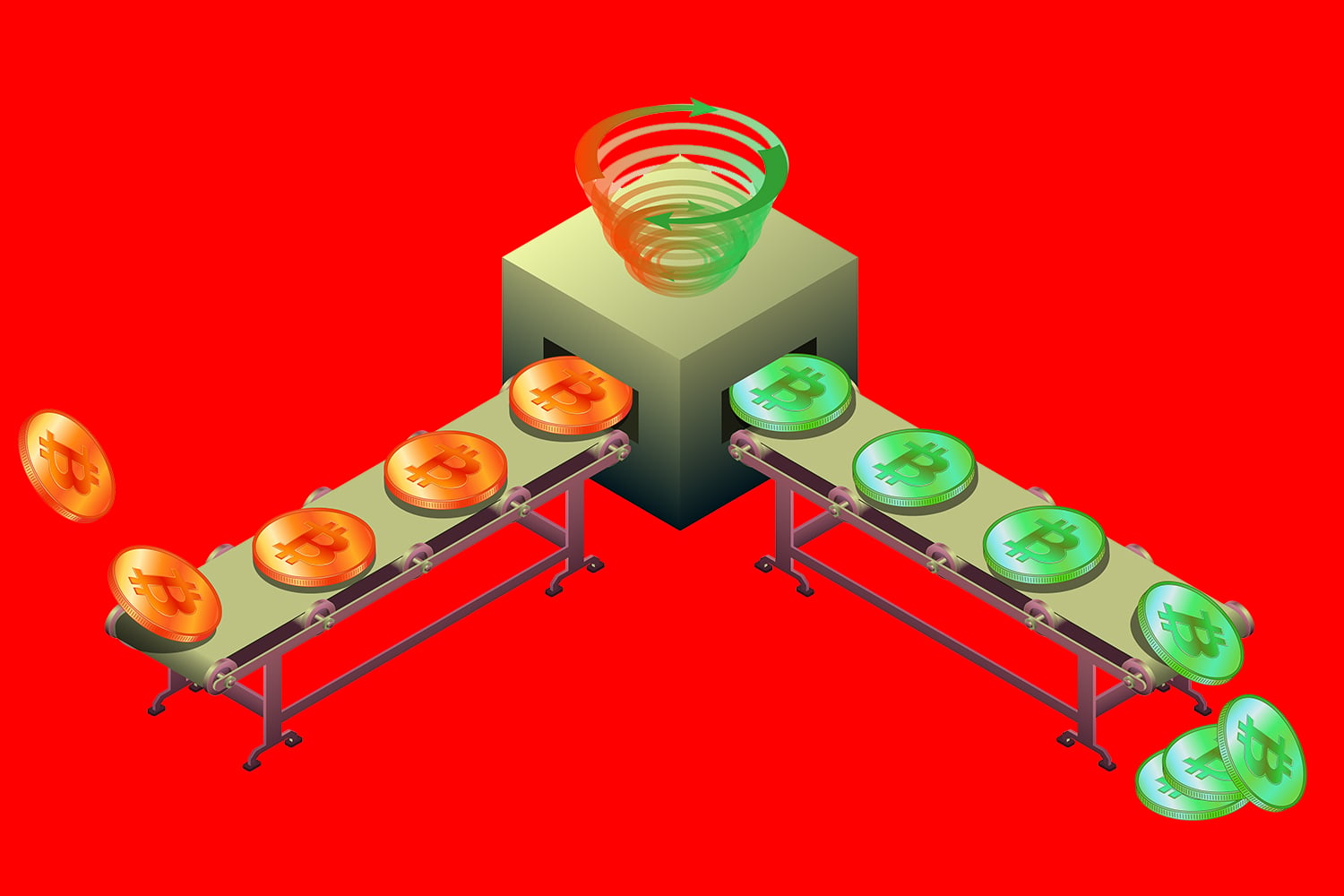

Europol, in partnership with international law enforcement agencies, has successfully shut down a major “Cryptomixer” service believed to be involved in large-scale money laundering across the cryptocurrency ecosystem. Cryptomixers—also known as tumblers—are platforms designed to obscure the origin and ownership of digital assets by mixing multiple transactions together. While some users claim privacy benefits, authorities argue these services are frequently used by cybercriminals, ransomware groups, and darknet marketplaces to hide illicit activity.

The operation, coordinated by Europol alongside authorities in multiple jurisdictions, involved extensive digital forensics, blockchain analysis, and the simultaneous seizure of servers and domain names. Investigators reported that the targeted mixer processed millions of euros’ worth of cryptocurrencies, helping criminals disguise the origins of stolen funds. The shutdown marks yet another step in the growing global crackdown on crypto-enabled financial crime.

According to Europol, the service played a key role in laundering proceeds from ransomware attacks, phishing schemes, and darknet drug sales. Advanced blockchain tracing tools helped authorities identify transaction patterns and link them to known criminal networks. This operation follows earlier takedowns of similar privacy services like ChipMixer, Blender.io, and Tornado Cash-related infrastructure—indicating a consistent enforcement trend.

Authorities also noted the increasing sophistication of criminal organizations using crypto-mixing tools. Modern mixers often integrate features such as time delays, multi-chain swaps, and decentralized smart contracts to enhance anonymity. However, with the advancement of blockchain analytics, law enforcement is becoming more effective at tracing transactions, even those routed through privacy protocols.

The shutdown of this cryptomixer is expected to send a strong message to others offering similar services without regulatory compliance. Governments worldwide are tightening anti–money laundering (AML) requirements for digital asset platforms, including know-your-customer (KYC) checks, transparency standards, and cross-border reporting obligations. Entities that fail to comply are likely to face similar enforcement actions.

This development also raises important discussions in the crypto community about the balance between privacy and regulation. While privacy advocates argue that mixers protect legitimate users from surveillance, regulators insist that anonymity tools must not become safe havens for criminal financing. The industry is now facing pressure to innovate compliant privacy technologies that preserve user rights without enabling illicit activity.

The Europol-led operation represents a significant win in the fight against crypto-related crime and reinforces the message that anonymity services operating without oversight will face increasing scrutiny. As authorities continue to enhance their blockchain intelligence capabilities, the crackdown on illicit crypto-mixing platforms is expected to intensify in the coming year.