[ad_1]

Lesser known than major cryptocurrency platforms such as Coinbase, eToro and Binance, FTX exchange and their native token (FTT) have begun to slowly go mainstream in 2021.

On the back of a strong run with new partnerships, funding and a visionary team, FTX exchange has begun to reap well-deserved rewards. While some are familiar with the exchange and what role they represent in the industry, many more remain in the dark.

What Is FTX?

FTX is a crypto trading platform established in 2019 by Alameda Research founders, Sam Bankman-Fried and Gary Wang following their disgruntlement with traditional crypto exchanges and their meagre offerings.

The pair set out to create a platform ‘by traders, for traders’ which would identify and solve the problems plaguing already established exchanges. Rather than follow in the footsteps of leading platforms such as Binance and others, the founders created a less conventional, cryptocurrency derivatives exchange.

Crypto derivatives exchanges are similar but also different to traditional crypto exchanges. Along with the usual trading options for spot trading (buying and selling the underlying asset), derivatives exchanges also allow you to use leverage and trade futures, options trading and perpetual contracts.

FTT Token

FTT is the native token on the FTX exchange. The team has always striven to ensure the future growth of the token by making it “the backbone of the ecosystem” and have taken steps to increase the allure of the token for those using FTX. They have chosen to dedicate a third of all exchange revenue to token burns which will ensure that scarcity is maintained in the system until half of the total supply has been burned.

The exchange also provides incentives for users who hold FTT. Holders will receive OTC rebates effectively reducing costs for them. For users looking to trade futures, FTT will also hold sway as the exchange gives discounts on trading fees to holders and allows them to use the token as collateral.

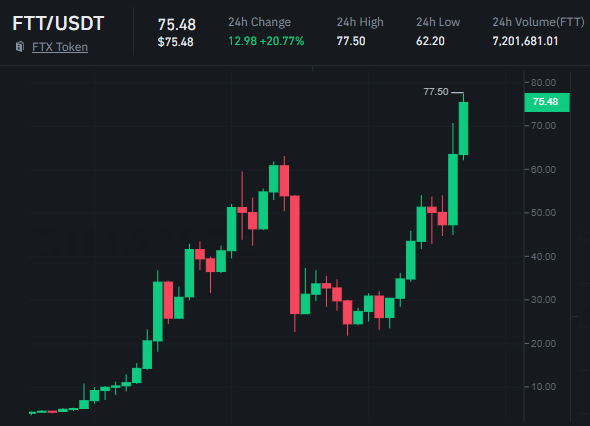

FTT price rise vs USDT since Jan 2021 – via Binance

How FTX Sets Itself Apart

As previously mentioned, FTX was founded by people who had lost faith in the options available in the existing exchanges at the time and what they offered. Rather than sit and rail, they took it one step further. They did it themselves. This background is evident throughout their whitepaper.

They mince no words and name specific exchanges such as OKEx stating what they lack and how they hope to plug the hole. Although there are many features in the works to do this, their whitepaper focuses explicitly on three:

Clawback prevention

To those familiar with derivatives trading, socialised losses are a pain to deal with. Exchanges offer margin trading, allowing you to make astronomical gains and conversely, devastating losses. While the exchange is usually protected from these losses through liquidation of the user’s account, sometimes, users take on very large margins which the exchange will be unable to cover in case of loss.

Enter, socialised losses. To cover for their losses exchanges distribute the loss to other traders, scalping from a wide range of people until its losses are balanced. FTX aims to change this. They have developed a truly innovative three-layer liquidation system that only resorts to clawback in a ‘worst-case scenario’.

Centralised collateral pool and stablecoin settlement

FTX has also chosen to tackle the liquidity problem in derivatives trading. Other exchanges have multiple wallets depending on the type of trade you choose to go into and even more wallets depending on what pair you choose to trade. FTX counteracts this problem by skipping through these and settling all trades in a centralised stablecoin pool.

This allows traders to post collateral in a single currency and ease the efficiency of trades. Rather than being forced to purchase other tokens needed for collateral which can be particularly counter-intuitive in the case of short positions, traders can provide collateral in the form of stablecoins which their PNL will also be settled in.

Leveraged tokens

Rather than the traditional form of margin trading which requires prior knowledge of the workings of the system alone, leveraged tokens serve to find a middle ground between margin traders and spot traders. They allow for ease of access of traders to the derivatives market. A trader hoping to take up a leveraged position can through the use of these tokens buy them directly on the exchange in the form of a token.

One such example of this is the ‘3X long ETHBULL’ token which will allow you to take a 3x leveraged long position in Ethereum. The simplicity of this in comparison to traditional margin trading allows easy pickup for users with less knowledge.

FTX’s Stellar Team

Separate from such innovative features, the FTX team is also a major reason why the company has done so well. Co-founders, Sam Bankman-Fried and Gary Wang had extensive knowledge and experience before starting FTX. Although he graduated from MIT with a degree in physics, Bankman-Fried began his career at Jane Street Capital, a top trading firm in the traditional financial markets.

Following his stint on Wall Street, he eventually started his own company along with Co-founder, Gary Wang which they named Almeda Research. The digital assets trading firm has seen massive success to date and is an industry leader. Working on Alameda Research eventually brought them to their current position today where they helm FTX which is fast becoming one of the leading figures in the market.

The rest of the FTX team is equally as impressive, boasting employees from a wide range of companies including Google and Facebook. Even with the array of talent on offer, the team still strives to be more than the sum of its parts and is consistently pushing the envelope.

FTT’s Recent Price Surge

The recent surge in the price of FTT is the culmination of months of work by a dedicated team. July saw the close of a stellar $900 million funding round (one of the largest for a crypto company) along with the launch of an FTX program that aims to make the company carbon neutral. August brought even more news with the company inking partnerships with Yield Guild Games and popular shark tank presenter, Kevin O’Leary.

Perhaps the greatest among these and the single largest contributor to FTX’s good fortune is the acquisition of LedgerX. LedgerX is a derivatives company that is licensed in the United States. This acquisition will finally allow FTX to present their offerings to the yet untapped US market. Prior to this, the strong regulation in the country served as a barrier to entry for the company.

This new development, however, seems to circumvent that and has served as a boost to FTT’s price as people anticipate the company’s entry into the US markets. The FTT price has more than doubled in the last month reaching a new all-time high of $70.21 and despite a recent pullback, looks set to keep going as the team keeps making strides.

Should You Buy FTT Now?

Despite glowing reviews and all things looking positive for the token and its team, there are still some caveats. Investing in FTT although attractive does come with some risks. According to analysts over 90% of the token supply is held by whales who hold midterm. For people looking to make a quick buck, they could obtain huge losses if whale movements impact the market before they can get out.

Regardless of this, the FTX team does seem to be the real deal and the ongoing plans they have coupled with their strong drive for excellence will no doubt continue to advance the token’s price in the future.

Many of the best cryptocurrency traders on Twitter are predicting FTT to reach at least $100. FTT is reminiscent of Binance Coin (BNB) which rose in value from $40 at the start of 2021 to a peak of $690. Native coins of exchanges have been very profitable.

As well as on FTX, investors can buy FTT and trade it on cryptocurrency exchanges such as Capital.com and Binance. It’s not currently listed on Coinbase and eToro although that may change soon with the recent pump in the FTT price making media headlines.

Capital.com – Our Recommended Crypto Platform

- CySEC, FCA & ASIC Regulated

- 4000+ Markets on one Trading App

- Zero Commission Fees, Low Spread

- Online Educational Courses – Learn to Trade

- 4/5 Trustpilot Rating

71.2% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

[ad_2]

Source link