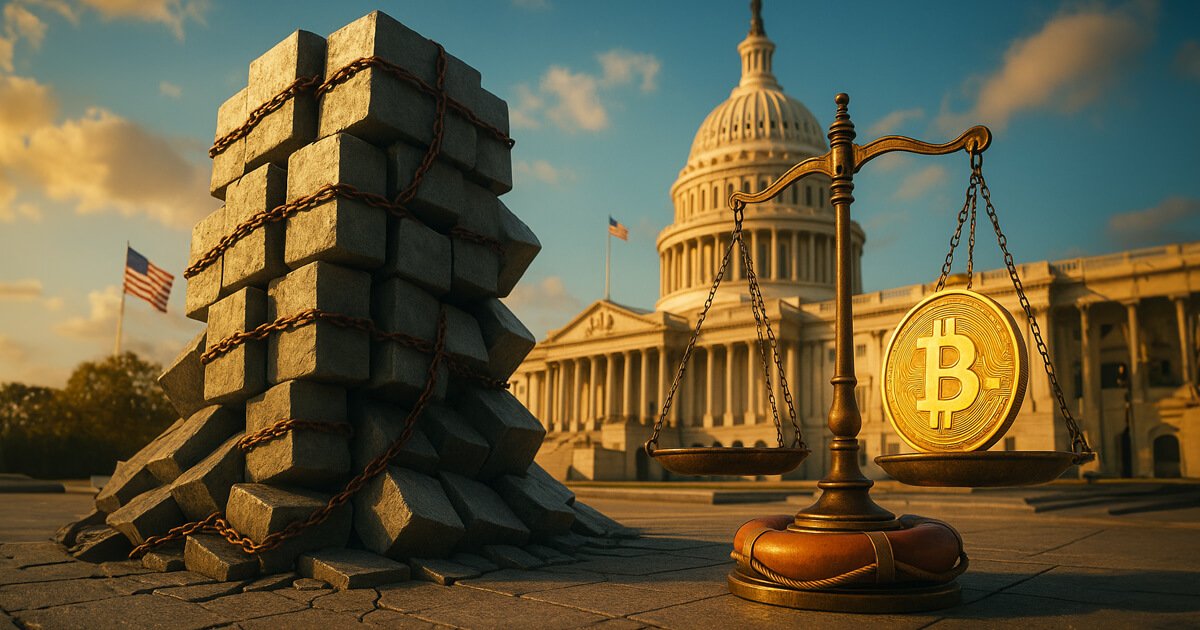

America’s national debt has crossed $38 trillion, surpassing the country’s annual GDP by nearly 31%.

The firm added that at this pace, “there is a 100% certainty of US bankruptcy with a long enough timeframe.”

This warning rang alarm bells worldwide as it showed how unsustainable the US government’s current fiscal policy was.

However, Bitcoin advocates saw this as proof that fiat money has reached the limits of credibility.

At first glance, the theory sounds like digital-age alchemy, turning code into solvency. Yet it has gained surprising traction as fiscal anxiety spreads.

In her view, holding Bitcoin alongside Treasuries would do what gold once did: signal credibility, hedge inflation, and perhaps, decades from now, help retire a fraction of the debt.

She said:

“[BTC will] secure our debt with a hard asset + we can audit it to prove reserves at any time.”

That rhetoric, once fringe, resonates in a world where fiscal expansion looks endless. But if the US ever attempted to use Bitcoin to extinguish its liabilities, how high would the flagship digital asset need to climb?

The math appears elegant at first. Divide $38 trillion in national debt by Bitcoin’s circulating supply of 19.93 million BTC, and you arrive at a figure near $1.9 million per coin.

At that price, Bitcoin’s total market capitalization would match the entire debt load of the US government.

But the equation breaks the moment you add reality. The US government doesn’t own 19.93 million Bitcoin, it owns only a fraction.

If Washington tried to use only that amount to clear its debt, the number would significantly explode.

Divide $38 trillion by 326,373 coins, resulting in $116.5 million per Bitcoin. This is about 1,000 times higher than the current market price, near $108,000.

At that valuation, Bitcoin’s total market capitalization would soar to roughly $230 trillion, which is more than twice the world’s GDP.

Meanwhile, even if prices somehow reached those heights, the mechanics would collapse long before the debt vanished.

So, attempting to liquidate even a small share of supply to “repay” government debt would instantly crater demand and destroy price depth.

Moreover, there’s less Bitcoin to trade than most assume.

That leaves closer to 16 million BTC in effective circulation. Adjust for that, and the so-called “debt parity” figure rises significantly to more than $2 million.

While Bitcoin cannot literally extinguish America’s debt, the exercise exposes a more profound truth about modern finance.

It shows that governments can create liabilities faster than markets can produce credible collateral. Every new borrowing widens the gap between what money represents and what it measures.

That asymmetry explains why Bitcoin continues to resonate in policy debates and portfolio strategies alike. Its design, capped at 21 million BTC, is in silent contrast to a financial system built on perpetual expansion. Scarcity, once treated as a relic of the gold era, has become the most valuable commodity in money.

For investors, Bitcoin has evolved from a curiosity into a macro hedge against a world where the denominator, the dollar itself, no longer feels fixed.