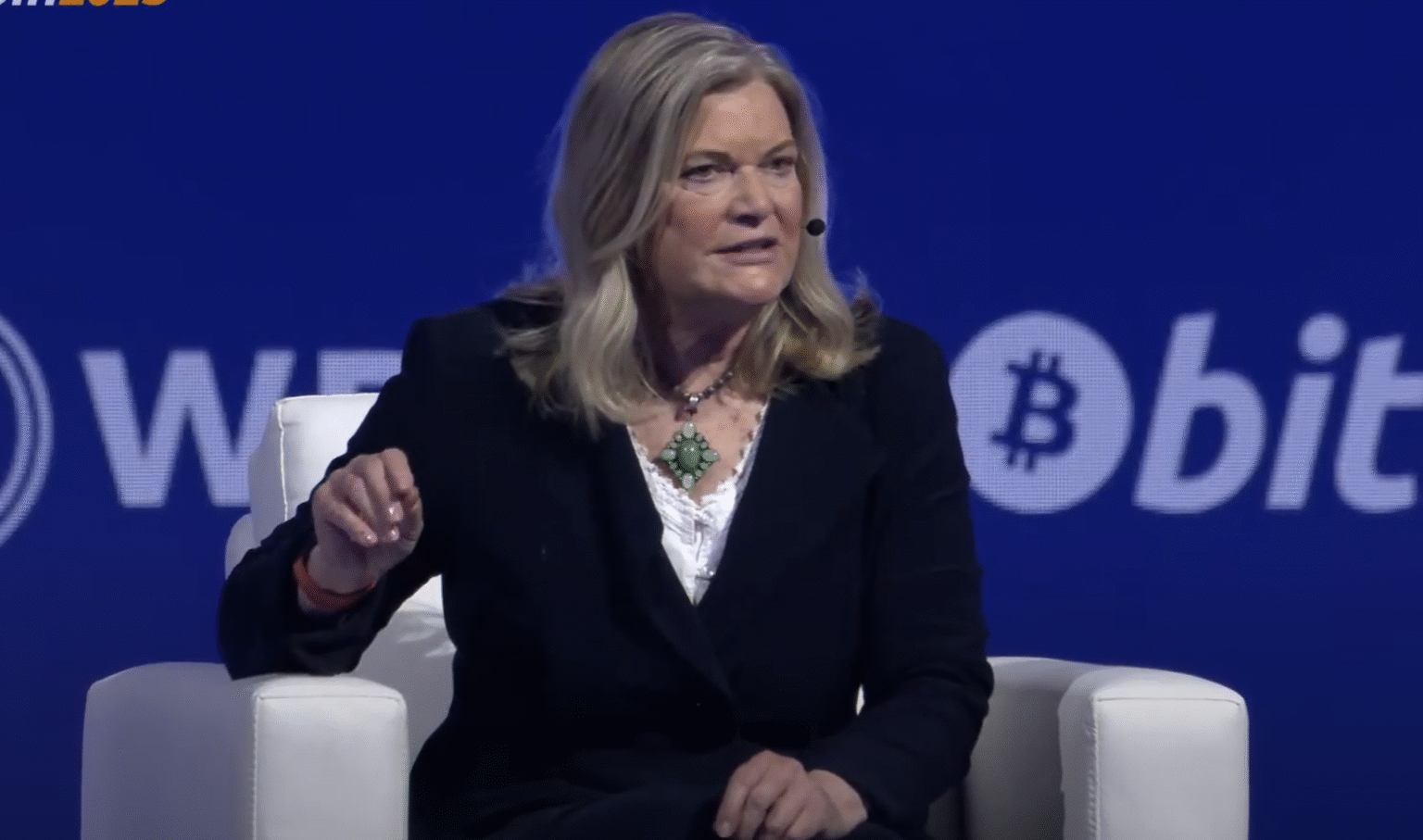

The opening day of the Bitcoin 2025 conference delivered an unmistakable political signal: President Donald Trump has thrown his weight behind legislation that would require the United States to accumulate a strategic reserve of one million bitcoin. Wyoming Senator Cynthia Lummis disclosed the White House commitment during a policy-heavy session on the conference’s main stage, flanked by Senators Marsha Blackburn and Jim Justice.

Modeled on the way Fort Knox anchors US gold holdings, the revised BITCOIN Act — first introduced in July 2024 and re-filed on 11 March 2025 — authorises the Treasury to purchase up to one million BTC over five years using “budget-neutral” mechanisms already available to the Federal Reserve and the Exchange Stabilization Fund. At Wednesday’s spot price of roughly $108,900, the position would be valued at about $108.9 billion, equal to 2.6 percent of the FY 2025 discretionary budget.

Lummis framed the reserve as both an energy and a security imperative. “When China forbade mining of Bitcoin, they did the United States a big favor because a lot of those mining operations came here,” she said, echoing Trump’s recent call to make “Bitcoin mining and America conjoined.” Pairing domestic hash-rate dominance with federal accumulation, she argued, would give Washington a “geopolitical advantage.”

That view, she added, is shared by senior uniformed officers. “I’ve talked to generals in our military who understand that economic power is as important as military power in addressing aggressors around the world — and there are generals … who are big supporters of having a strategic Bitcoin reserve for that reason.”

For now, the path to a trillion-satoshi reserve runs through the Senate cloakrooms. But the political optics are shifting: a sitting president has endorsed federal Bitcoin accumulation, the Pentagon is quietly blessing the concept, and three US states have already legislated partial blueprints.

At press time, BTC traded at $108,905.