Equity screens show a broad red, with the S&P 500 down around 1.8% and the entire crypto market under pressure simultaneously.

What appears to be an unexplained wipeout is, in fact, a layered move driven by interest rate expectations, crowded positioning in tech and AI names, and a shift in global risk appetite that is pulling liquidity from the parts of the market that led the prior rally.

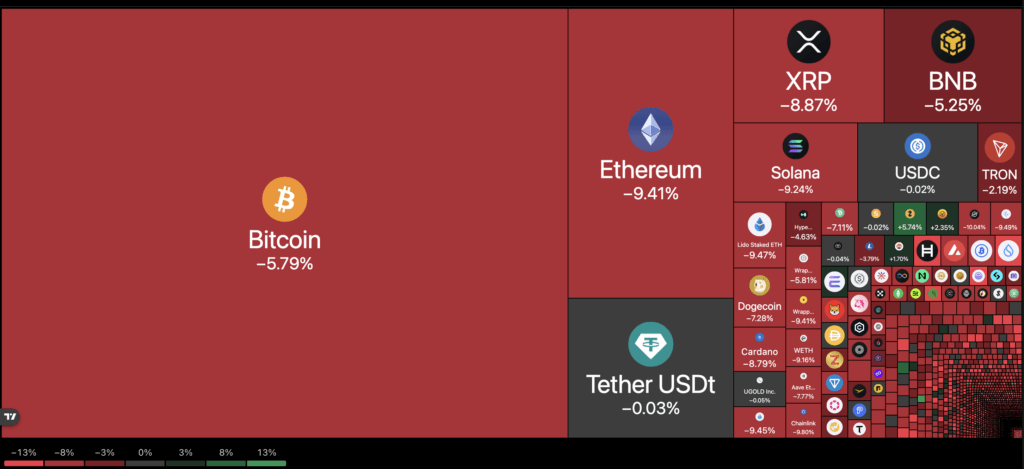

Over $1.1 billion was wiped out from futures markets, according to CoinGlass data, with over $500 million liquidated from Bitcoin positions alone.

The first piece sits with the Federal Reserve. Markets spent much of the year pricing in a clear path toward rate cuts and a softer stance on policy.

Recent communication has pushed back on that comfort, with officials leaning toward keeping policy tight for longer and treating incoming data with caution.

Investors had built in a faster easing path, and the adjustment toward fewer or later cuts has pushed yields higher across the curve.

Higher real yields compress the present value of long-dated cash flows, which hits growth stocks and long-duration assets and pulls forward the valuation reset that had been delayed by abundant liquidity.

That repricing feeds directly into the sector that carried much of the index-level gains. The latest leg of the S&P 500 move was led by mega-cap tech and AI-related names.

Markets have been debating whether the earnings and spending path can match the premium baked into those stocks.

When these names lose altitude, cap-weighted indices move with them, and passive products like SPY show broad declines even if other sectors are relatively stable.

The move is not only about valuations, it is also about positioning and flows. There has been a rotation out of the prior “everything up” phase toward a more defensive stance as policy, macro, and earnings uncertainty builds.

That is visible in the distribution of sector returns. In the most recent session, technology stocks fell by around 2%, while healthcare stocks gained close to 0.9%.

Capital is shifting from high-growth areas with multiple returns to value and defensive sectors, such as healthcare and, in some cases, energy.

From an index-level view, however, the heavy weight of tech means those smaller pockets of green are not enough to offset the drag from mega caps, so the screen still looks uniformly red.

Macro and political headlines are adding to that caution. The Dow fell approximately 397 points in a single session as traders sought to reduce risk and raise cash.

Concerns around fiscal negotiations and the prospect of government shutdown brinkmanship in the United States have added another source of uncertainty to the outlook for growth and policy.

In Europe, the upcoming UK budget forecasts are causing markets to react to the prospect of higher taxes and tighter fiscal room, which is pressuring domestic stocks and weighing on broader European sentiment.

Together, these factors create an environment where cross-border flows into US equities can slow or reverse, which further amplifies weakness in benchmarks such as the S&P 500.

This backdrop matters for crypto because the same drivers shape funding, leverage, and risk appetite on-chain and in derivatives.

When real yields rise, the dollar strengthens, and volatility increases in stocks, multi-asset funds, and crossover traders often reduce their exposure across the board.

That means de-risking in tech portfolios can coincide with reductions in crypto holdings, forced liquidations in perpetual futures, and lower demand for leverage.

Even crypto-native flows feel the impact as stablecoin yields compete with Treasury rates and marginal capital faces a clearer opportunity cost.

At the same time, the structure of equity indices shapes how “everything red” appears on trading dashboards. SPY tracks large-cap US stocks, with considerable weight in information technology and communication services.

When those sectors come under pressure, the ETF reflects that move almost immediately.

SPY’s drop of roughly 1.8% fits that pattern, where heavy selling in a concentrated group of leaders pulls the rest of the basket lower even if some defensive or value names are flat or slightly positive.

Flows also matter around the edges. When buyback programs pause during blackout windows, a steady source of corporate demand for shares temporarily disappears.

If that coincides with higher volatility, hawkish central bank messaging, and headline risk around budgets or shutdowns, selling pressure has fewer natural counterparties.

Earnings results have been solid in many cases; yet, the bar set by prior guidance and market expectations leaves less room for an upside surprise.

In that environment, “good enough” numbers can still lead to downward price moves as traders lock in gains and fade stretched narratives.

For crypto markets, the forward path hinges on how this macro repricing evolves rather than on any single equity session.

If the higher-for-longer policy remains the base case and the cost of capital stays elevated, the hurdle rate for speculative and long-duration assets remains high.

For now, a slower path to rate cuts, pressure on crowded tech and AI trades, and more cautious global capital flows are working together to keep both equities and crypto in the same red zone.