According to CryptoSlate data, the token jumped to $2.59, its highest price since March.

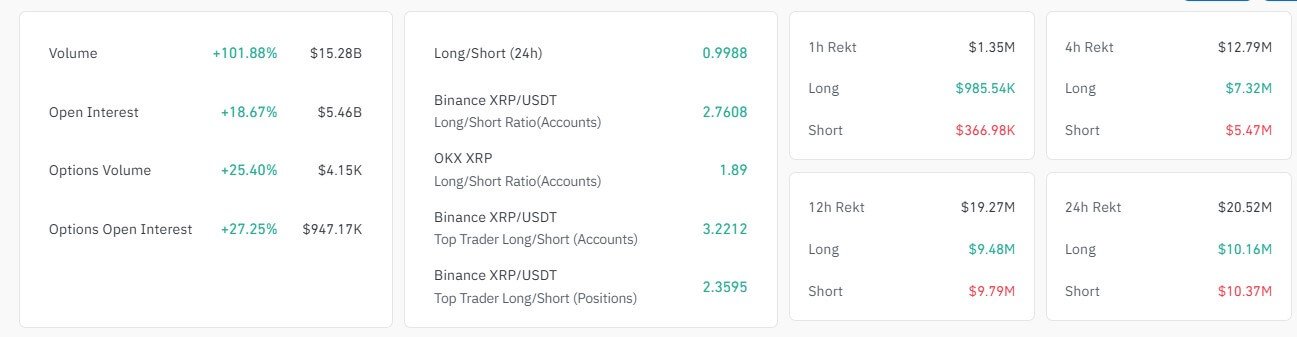

The surge triggered more than $20 million in liquidations across derivatives platforms, based on Coinglass data.

XRP’s momentum comes amid growing confidence in its legal and institutional outlook, with the futures market showing a substantial uptick in speculative activity.

Open interest measures the total number of active futures contracts and is often considered a proxy for market conviction. When this metric rises, it usually signals growing trader confidence.

Although the figure dipped to $3.6 billion during the broader market pullback in March and April, it has since rebounded to $5.4 billion as of press time. This signals renewed trader interest amid the current crypto rally.

In XRP’s case, this surge is backed by a more than 100% increase in trading volume, which now exceeds $15.28 billion.

Under the deal, Ripple will pay $50 million to the SEC, while the remaining $75 million—previously held in escrow—will return to the company. The agreement also vacates a previous injunction.