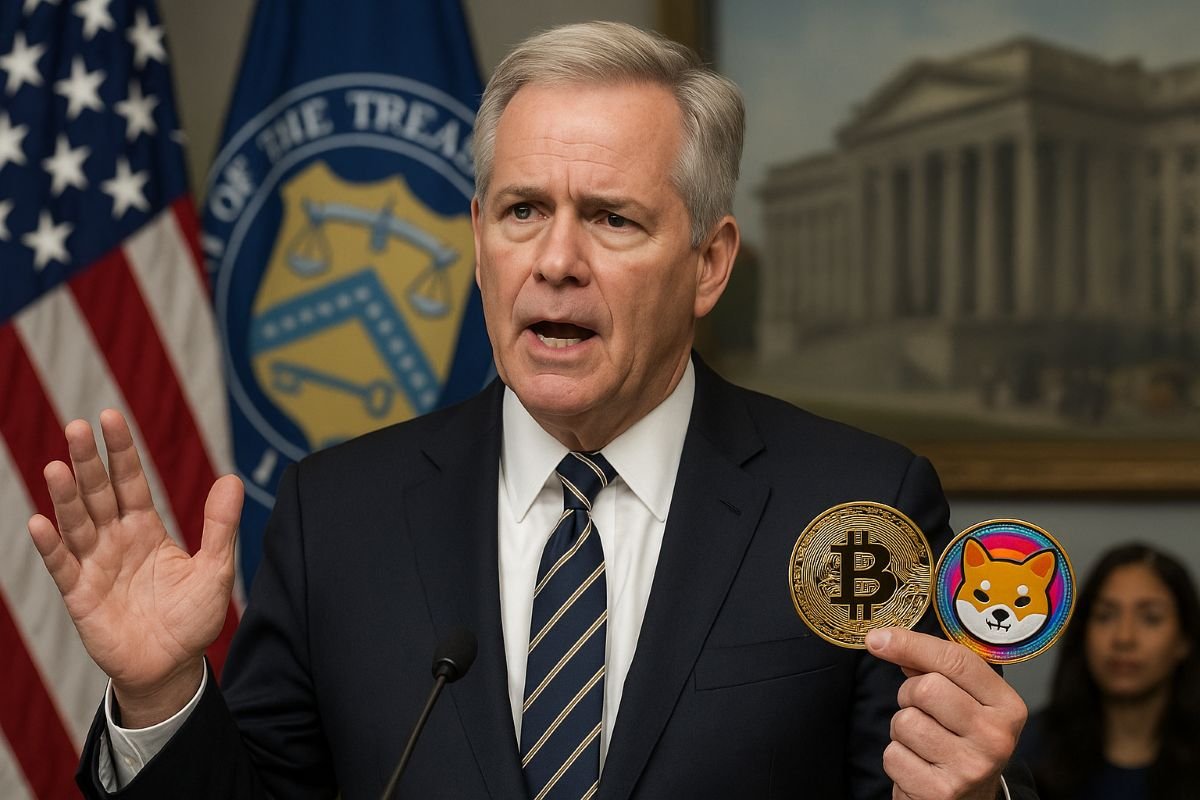

US Treasury Secretary Scott Bessent caused market jitters yesterday. And all it took was for him to imply that the government is ruling $BTC purchases for the strategic Bitcoin Reserve.

Still, he quickly debunked such a claim, which eased some of the market’s panic.

‘We’ve also started to get into the 21st century, a Bitcoin reserve. We’re not going to be buying that, but we are going to use confiscated assets and continue to build that up,’ commented Bessent.

Though on a positive note, he did say that the Treasury won’t be selling its $BTC stash. According to him, it’s currently worth ‘somewhere between $15B and $20B.’

After $BTC took a tumble, Bessent didn’t hang around to set the record straight. He quickly took to X, saying the ‘Treasury is committed to exploring budget-neutral pathways to acquire more Bitcoin to expand the reserve.’

As market confidence returns, now might be an opportune time to cast your attention on high-potential tokens with ambitious use cases.

Despite being a Shiba Inu coin on steroids (literally), $MAXI aims to offer more than just hype; it has plans for gamified tournaments and integrations with futures trading platforms in the future.

That said, you only need to check out its presale website to see that meme culture runs deep in its DNA. It has bold slogans like ‘Feel the Maxi Pump’ and ‘Forget Your Limits’ splashed across the page.

Supporting the project’s growth are its fair and sustainable tokenomics. Maxi Doge allocates a hefty 40% of its total token supply to marketing. This way, it can boost its visibility continuously to help bring up its token’s price.

Meanwhile, an additional 15% is earmarked for the dev team, so gear up for ongoing developments and innovation.

$CHEX is the linchpin of Chintai, a regulated digital asset platform that tokenizes real-world assets (RWAs).

The platform makes it easy to create, trade, and manage tokenized assets, including issuance and secondary trading, all in a fully compliant setup.

It’s powered by Chintai Nexus, its own tech built on the EOS blockchain with the Antelope protocol. Doing so means it can enable fast, scalable, and low-cost transactions.

Its native token, $CHEX, powers the entire ecosystem. It covers network resource fees, plus staking, governance, and liquidity incentives.

To make Bitcoin speedier, Bitcoin Hyper pledges to batch transactions off-chain before settling them on Bitcoin’s base layer. Doing so would also help the network cut congestion and lower fees.

Ethereum, however, has the highest TVL at a hefty $94.74B, most of which is locked in smart contracts and dApps.

With Bitcoin Hyper, Bitcoin could unlock massive liquidity and boost its position as a true DeFi powerhouse, just like Ethereum.

Bessent’s comment on Bitcoin reserve purchases shook the market, but his swift backtrack reignited confidence.

The rapid decline in $BTC’s price underscores just how sensitive the crypto market is. Yet, it also shows how quickly sentiment can switch when uncertainty is resolved.

With confirmation that the US government will explore ways to grow its Bitcoin reserve, $BTC is stabilizing.

And as always, when $BTC shows promise, so too do smaller low-cap coins – it’s the market leader, after all.

This isn’t investment advice. DYOR and never invest more than you’d be sad to lose.